Time to read :

1 min read

Cash flow is the lifeline of any enterprise, yet 60% of treasury teams still rely on error-prone spreadsheets. In today’s volatile market, manual tracking isn't just inefficient, it is a security risk. Businesses need a system that can automate liquidity planning, secure payments, and handle unexpected costs instantly.

They need a system that can pay their employees, cover bills, and handle unexpected costs efficiently.

Cash management software helps them track their financial position, automate routine tasks, and make faster and data-driven decisions. It gives them complete control over every dollar that moves through their business.

But how do businesses build one that fits their organization’s needs perfectly?

Dive into this blog on cash management software development to learn about it in detail.

What is Cash Management Software?

Cash management software is a digital platform that allows businesses to monitor liquidity, automate bank reconciliations, and forecast cash flow in real-time. By centralising data from bank accounts and ERPs, it provides a single source of truth for financial decision-making.

It records every cash transaction, gathers data from bank accounts or ERP systems, and turns it into real-time dashboards and reports. With the help of this software, the finance team gets a complete and up-to-date view of the company’s cash position anytime.

In short, cash management system software solutions is a rich set of tools that improve an organization’s cash flow. It ensures the business always has enough liquidity for investments and emergencies.

Cash Management Software 2026 Market

The cash management software market is growing rapidly. Businesses are moving from outdated and on-premise tools to modern, cloud-based, and AI-powered platforms.

Here are the numbers that show how big the transformation is:

Market Growth: The cash management software market is worth $20.3 billion in 2024 - 2025. It is expected to grow to $62.16 billion by 2033, at a CAGR of 13.24%.

Regional Leaders: North America is leading the market with a 39.5% share, followed by Asia-Pacific region at 13.5% CAGR. Countries like India, China, and Vietnam are on the list of this massive digital transformation.

Segment Trends: Cloud-based deployments now make 64.5% of the global market. Meanwhile, small and medium enterprises (SMEs) are adopting digital cash solutions rapidly. They are growing at a CAGR of 16.3%.

So, if you build a custom cash management software today, you are prone to reduced debt and increased interest income in the future.

Key Features of Cash Management Software

A custom cash management software should include features capable of managing the entire lifecycle of a company’s cash. When you develop a cash management software, these are the core features you need:

Core Financial Management Features

A cash management software must have these financial features:

Cash Flow Forecasting

Cash Flow Forecasting is the backbone of cash management software. It helps businesses predict future cash inflows and outflows using past data and current trends. The feature ensures there is enough liquidity to cover expenses and plan for growth. Using this feature, the users can project their cash positions weeks or months before and avoid unexpected shortfalls.

Bank Account Reconciliation

This is an automated reconciliation feature that matches bank transactions with accounting records to keep financial data accurate. It reduces manual work, prevents errors, and quickly flags any mismatches.

Payment Processing

A strong cash management platform should make paying people easy and reliable. Having this feature in a software helps the finance team handle everything securely and on time. It supports multiple payment types, including ACH and wire transfers, checks, and both one-time and recurring payments.

Expense Tracking

Businesses should be able to track and categorize expenses in real-time easily. The system includes custom expense categories and detailed spending analytics. This way, they identify spending patterns, control unnecessary costs, and stay within budget.

Invoicing and Billing

A strong invoicing feature allows users to create professional invoices, track payment status, and encourage faster payments. The system supports automated invoice generation, multiple currencies, and customizable templates for branding consistency.

Reporting and Analytics

A company should be able to generate detailed reports and gain insights into cash flow trends, financial performance, and areas of improvement. Using this feature, they can understand financial health and make strategic decisions effortlessly through advanced data visualization services.

Payables and Receivables Management

Managing incoming and outgoing payments accurately keeps cash flow stable. The software ensures vendors are paid on time, customers are reminded about pending invoices, and all transactions are visible and organized.

Liquidity Management

A company tends to stay liquid when it has real-time visibility into cash balances and short-term investments. This feature ensures there’s always enough cash for operations while earning returns on surplus funds.

Multi-Currency Support

For global businesses, handling multiple currencies is essential. A cash flow management software include automatic currency conversions and real-time exchange rate tracking to reduce risks in international transactions.

Electronic Bank Account Management (eBAM)

This feature automates and simplifies tasks like opening or closing bank accounts, updating signatories, setting transaction limits, and tracking fees. It ensures the company has total control over all banking activities.

Security and Compliance Management

Dealing with sensitive financial data requires strict adherence to regulations. Essential security features include Multi-Factor Authentication (MFA), Role-Based Access Control (RBAC), and data encryption standards (AES-256) to ensure compliance with GDPR, SOX, and PCI-DSS.

Advanced AI-Powered Features

Besides core financial features, a cash management software should have the following AI-driven features:

Predictive Analytics

Using AI development services and machine learning, the system can predict future cash trends based on past performance. It identifies seasonal patterns and helps companies prepare for financial ups and downs in advance.

Automated Reminders

The software send automatic alerts for upcoming payments or overdue invoices. Having this feature in a software reduces missed deadlines and improves financial discipline.

Client and Supplier Risk Assessment

AI can evaluate the financial health and reliability of clients or suppliers through credit scoring and data analysis. This minimizes bad debt risks and improves overall financial stability.

Smart Expense Suggestions

The platform can offer AI-driven recommendations on cutting costs or reallocate budgets based on spending behavior and market data.

Automated Invoice Follow-Ups

AI can automatically send follow-up reminders for unpaid invoices. This improves cash collection rates and keeps cash flow steady.

Fraud Detection

Machine learning algorithms can flag unusual transactions or spending behavior, which helps prevent fraud and protect company assets.

Cash Flow Optimization

This feature can suggest the best times to make payments or investments. As a result, businesses can use their resources efficiently and maintain a healthy cash balance.

Smart Budgeting

AI-based budgeting tools analyze past spending patterns and recommend optimized allocations for different departments.

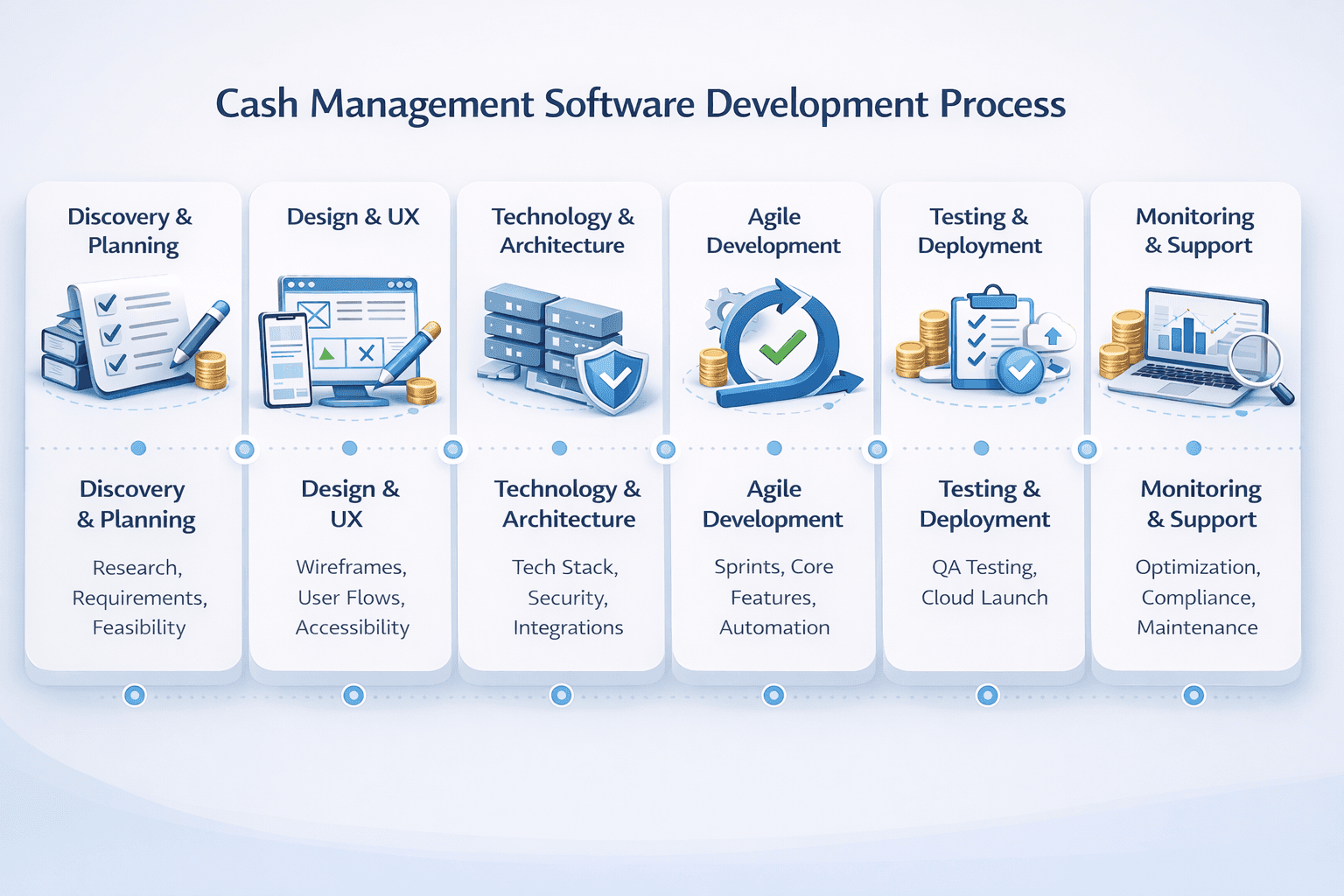

Steps to Develop a Custom Cash Management Software

A custom cash management software application requires a systematic and strategic approach. Below are the key steps to develop a custom cash management software.

Step 1: Planning and Research (Discovery Phase)

The discovery phase focuses on research, analysis, and strategic planning. Here, the development team studies the market to understand user demands, current industry trends, and what competitors are offering. They look for gaps in the existing system and identify opportunities for innovation.

The team also analyzes your business requirements in detail. They engage with stakeholders from finance, accounts, and treasury teams to gather insights into workflows that need improvement.

Finally, they assess the technical feasibility of your idea and build a clear strategic framework. This includes defining key performance indicators (KPIs), success metrics, and project boundaries. The discovery stage ensures your cash management software development project is grounded in data and clear direction.

Step 2: Requirements Gathering and Prioritization

Now, the team works on turning ideas into specific, actionable requirements. They gather detailed inputs from all stakeholders to ensure every department’s needs are represented.

The team lists all required features, like cash flow forecasting, budgeting, reporting, and payment processing. Then, they prioritize them using frameworks, like MoSCoW (Must-have, Should-have, Could-have, Won’t-have), to determine what is essential for your first release. They also document functional and non-functional requirements, which cover performance, security, and scalability.

Before moving ahead, the development team validates the list with stakeholders to confirm accuracy and alignment. This step helps prevent confusion later in the custom cash management software development process.

Step 3: UI/UX Design

The design phase focuses on creating a clean, intuitive, and user-friendly experience. UI/UX Design experts first start by sketching wireframes that outline how each screen and feature will look. This helps visualize how users will explore the system and interact with key components.

Then, they map out user flows to ensure smooth and logical movement throughout the platform. The interface is designed with consistent branding, clear typography, and visual hierarchy so users can access information easily. Accessibility is also very essential. Designers follow WCAG guidelines to ensure that the platform is usable by everyone.

Furthermore, they create interactive prototypes for early feedback and user testing. A design system is developed to maintain visual consistency across the entire software. This stage ensures the product is functional as well as engaging and easy to use.

Step 4: Technology Stack Selection

Developers must select the tools that match the project’s performance, scalability, and integration needs during the development process.

Here is the list of technical stacks they use:

Frameworks like ReactJS, AngularJS, or VueJS for the frontend.

Security and Compliance Testing: Conducting penetration tests and validating adherence to financial regulations like PSD2, GDPR, and PCI-DSS to prevent legal liabilities.

Databases like MySQL, PostgreSQL, or MongoDB to store and manage financial data efficiently.

Cloud platforms like AWS, Google Cloud, or Microsoft Azure for hosting due to their reliability, scalability, and strong security.

DevOps tools like Docker, Git, and Kubernetes for faster and smoother deployment.

Security frameworks like OAuth and encryption protocols to protect sensitive financial data.

AI and ML tools, like TensorFlow and PyTorch, to power intelligent forecasting and analytics.

Third-party APIs for payment gateways, accounting systems, and CRM platforms to create a connected ecosystem.

Step 5: Development (Agile Implementation)

In this phase, developers use agile methodology and break the project into smaller and manageable sprints. Each sprint lasts for two to four weeks and focuses on building specific features and functionalities.

The process begins with essential modules, like cash forecasting and reconciliation, followed by advanced automation and analytics tools. Regular sprint reviews keep stakeholders updated and ensure transparency. Continuous integration and automated testing maintain code quality and allow flexibility for adjustments if new requirements arise.

Throughout the custom cash management software development process, code reviews and thorough documentation ensure maintainability and consistency. This sets the foundation for a stable and scalable solution.

Step 6: Integration

Integration connects your cash management software with other essential business tools. During this phase, APIs are developed and configured to enable secure communication between systems.

The software is integrated with banking APIs, accounting platforms, payment gateways, and ERP systems for real-time data flow. It ensures that transactions, reports, and updates stay consistent across all departments.

Developers then perform extensive tests to confirm that data synchronization is accurate and smooth. If any issue occurs, strong error-handling and logging mechanisms help identify and fix them quickly. This process ensures that the final product operates as an easy part of your financial ecosystem.

Step 7: Testing and Quality Assurance

In this stage, developers and QA teams perform various tests to ensure your system runs smoothly, securely, and error-free.

They conduct:

Functional test to check that each feature works as intended.

Performance test to measure how the platform performs under heavy workloads or multiple users.

Security tests, like penetration tests and audits, to find and fix vulnerabilities.

Usability and compatibility tests to ensure the system works smoothly on different devices and browsers.

User Acceptance Testing (UAT) to try the system and confirm it meets their needs.

The team leverages Quality Assurance services to track, prioritize, and resolve every identified bug before launch to guarantee a reliable product.

Step 8: Deployment and Launch

After testing, the software is ready for deployment. Developers choose the best deployment strategy, whether it is a phased rollout, a full launch, or running parallel systems. The system is deployed on secure cloud servers, and all configurations, permissions, and settings are finalized.

If new software replaces an old one, historical data is carefully migrated to maintain continuity. Comprehensive user training, detailed documentation, and support resources are provided to ensure teams adapt easily. A detailed go-live support team monitors performance post-launch to address any immediate issues.

Step 9: Monitoring and Optimization

Once the software is live, continuous monitoring becomes essential. Developers track system performance, speed, uptime, and error rates to ensure everything runs smoothly.

They use analytics tools to study user behavior and identify which features are most used or need improvement. The team also collects feedback through surveys and user interactions, which help them in future updates.

This stage keeps your system efficient, scalable, and aligned with evolving business needs.

Step 10: Support and Maintenance

After deploying your custom cash management software, the team provides consistent support and maintenance. They regularly update the software with new features, improve performance, and patch security vulnerabilities.

A dedicated technical support team assists users through multiple channels, like email, chat, or phone. This ensures issues are resolved quickly. Backup and disaster recovery systems protect your financial data and ensure business continuity in emergencies.

The software is continuously monitored for compliance with new financial regulations and security standards. Documentation is updated regularly, and scalability plans are reviewed to support business growth. This final step keeps your system strong, compliant, and future-ready.

Challenges in Cash Management Software Development

Building a custom financial platform comes with specific hurdles. Being aware of them ensures a smoother development process.

Legacy System Integration: Many banks still use outdated legacy systems (like COBOL). Your software must use modern APIs or middleware to communicate with these older banking interfaces effectively.

Data Security Standards: Financial software is a prime target for cyberattacks. Implementing bank-grade security protocols without compromising user experience is a delicate balance.

Regulatory Changes: Financial laws change frequently. Your system architecture must be flexible enough to update rules without rewriting code.

Cost for Custom Cash Management Software Development

The cost of building a cash management system depends on the project’s size, complexity, and specific business requirements. Typically, the cost of cash management system development ranges from $45,000 to $350,000.

Let’s look at the detailed cost breakdown for developing this software:

Cost Breakdown by Project Complexity

Project Type | Estimated Cost Range | Ideal For |

|---|---|---|

Basic System | $45,000 - $80,000 | Small businesses or startups |

Mid-level System | $80,000 - $150,000 | Mid-sized companies |

Advanced Enterprise Solution | $150,000 - $350,000 | Large enterprises, financial institutions, Fortune 500 companies |

Key Budget Drivers

Integrations: When you connect a new bank, ERP, or external financial system, the development cost increases by 20-30%. Each integration requires additional work to align different data formats and ensure easy communication between systems.

Labor Costs: Skilled developers play a crucial role in your overall budget. Outsourcing software development or using a hybrid development model can reduce costs. But having experienced technical leadership is essential for a high-quality product.

Maintenance: After launch, you need to spend about 15-20% of the original development costs annually for updates, bug fixes, and security improvements. Regular app maintenance keeps your system secure, stable, and compliant with evolving regulations.

Regional Cost Variations

Region | Hourly Rates (USD) |

|---|---|

North America | $40 - $250 |

Western Europe | $35 - $180 |

Eastern Europe | $25 - $110 |

Asia | $20 - $80 |

South America | $25 - $120 |

Australia | $35 - $150 |

Final Opinion

The global shift toward cash management software development is transforming how businesses manage their most critical asset. Today, relying on manual processes or spreadsheets can trap millions in idle cash and slow down decision-making.

While developing a custom system may seem costly, the benefits are worth the investment. Companies that use AI-powered and cloud-based systems gain real-time visibility and can react faster to financial changes. The future belongs to those who turn their treasury operations into intelligent and automated systems.

Have an Idea for an App or Website?

At Deliverables, we specialize in building custom digital products that solve real-world problems. Tell us your idea, and our expert team will help you craft a plan to build your dream.

Some Topic Insights:

How does custom cash management software help prevent fraud?

Custom cash management software integrates “Positive Pay” (verifying checks against an approved list) and real-time anomaly detection to spot unauthorized transactions instantly. It also uses automated reconciliation, which reduces the “window of vulnerability” that exists in manual processes.

What is the typical timeline for development?

Why is custom development better than an off-the-shelf solution?

What is the difference between Treasury Management Systems (TMS) and Cash Management Software?

What is cash management software development and why do businesses need it?