Time to read :

1 min read

85% of financial companies are implementing AI to improve operations and decision‑making these days. Building a strong trading platform takes more than technical work. It requires a strategic MVP (Minimum Viable Product) strategy to enter the market quickly and effectively. Traders depend on accurate signals, secure processes, and smooth platform performance.

Today, advanced tools are taking the lead for businesses to manage profitable opportunities. The rise of intelligent stock trading apps offers a clear solution while driving more efficiency. On that note, Deliverables Agency can help you with this opportunity by offering expert AI Stock Trading App Development solutions tailored to meet your demands.

What is an AI Stock Trading App?

An AI Stock Trading App relies on deep AI integration to improve investment decisions. What it does is use algorithms to analyze market data while executing trades in real-time. Through seamless API integration with global financial exchanges, the app ensures accuracy as well as speed. Here are what the app must include.

Real-time Price Tracking

Markets shift within seconds, and price visibility cannot lag behind. Real-time tracking keeps values current across all listed assets without manual refresh. This clarity allows traders to react with speed during active sessions and avoid decisions based on outdated numbers.

Pattern Detection

Some market moves repeat themselves quietly. Pattern detection highlights these repetitions by studying price behavior and volume activity across timeframes. Instead of scanning charts for hours, traders receive clear signals that point to possible opportunities forming beneath the surface.

Sentiment Study

Price action often follows emotion before logic. Sentiment study captures market mood by reviewing news cycles, analyst opinions, and public discussion. This added context helps traders understand why prices move, not just how they move.

Automated Orders

Automation brings discipline into trading decisions. Orders execute the moment predefined conditions are met, without hesitation or emotional interference. This approach helps traders follow planned strategies even when markets move quickly or stress levels rise.

Portfolio Balancing

A healthy portfolio needs regular attention. Portfolio balancing reviews asset distribution and highlights areas that require adjustment. This process prevents overexposure and helps maintain consistency as market conditions and asset performance shift over time.

Risk Flags

Every trade carries exposure. Risk flags act as early warnings when volatility spikes or positions stretch beyond safe limits. These alerts provide time to respond, reassess, and protect capital before small issues grow into larger setbacks.

Performance Reports

Progress becomes clear through reflection. Performance reports break down trading history, outcomes, and patterns over time. Traders gain insight into what worked, what failed, and where adjustments can improve future results.

User-level Strategy Settings

Trading styles vary widely. User-level strategy settings allow traders to shape signals and actions around personal goals and comfort levels. This control keeps the system aligned with individual preferences while maintaining structured guidance throughout market activity.

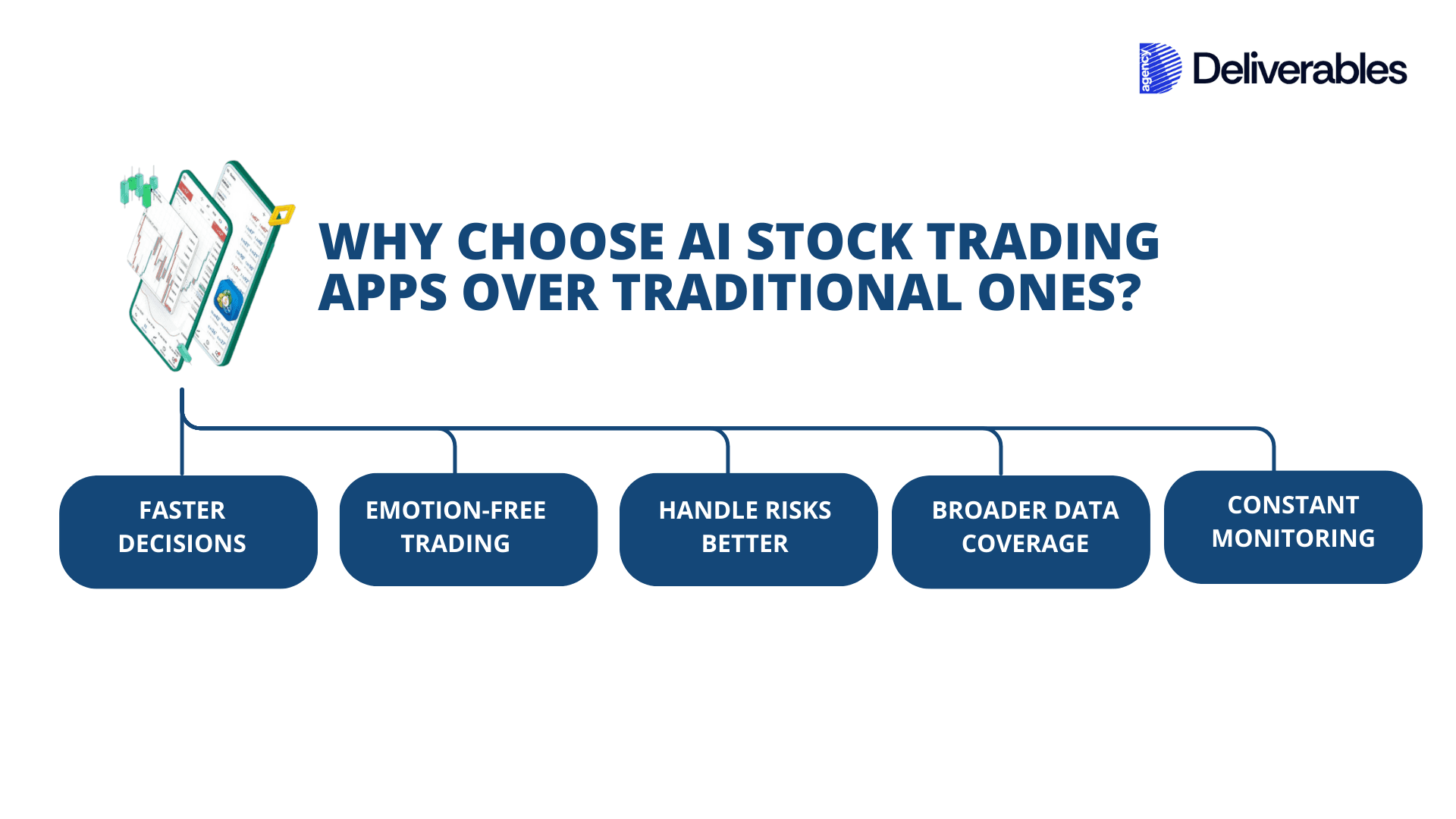

Why Choose AI Stock Trading Apps Over Traditional Ones?

For businesses and financial institutions, AI stock trading apps offer a significant edge over traditional platforms, which can be slower and less efficient in handling large-scale operations. Our solutions enable faster decisions, data-driven strategies, and enhanced risk management tailored to corporate needs.

Faster Decisions

AI systems can process massive market data in seconds, generating actionable insights and trade signals instantly. This helps firms respond quickly to short-term opportunities, improving operational efficiency and competitive advantage.

Emotion-Free Trading

Automated AI trading removes emotional bias from decision-making. Businesses can implement rules-based strategies consistently, avoiding impulsive trades and maintaining steady portfolio performance across market conditions.

Handle Risks Better

AI platforms provide real-time alerts on volatility, portfolio exposure, and potential losses. Built-in guardrails enable firms to monitor and manage risk proactively, protecting assets and client investments.

Broader Data Coverage

Our AI tools analyze news, social sentiment, trading volumes, and historical patterns simultaneously. Firms gain a wide-angle view of the market, enabling more informed, confident strategic decisions.

Constant Monitoring

AI trading apps operate 24/7, monitoring markets in real time. Firms receive instant notifications for critical events, eliminating the need for constant manual oversight and reducing operational load.

A Differentiating Guide to AI Stock Trading Apps vs Traditional Trading Apps

Here’s an overview of AI stock trading apps vs traditional trading apps

AI Stock Trading App | Traditional Trading App |

|---|---|

Processes vast data with predictive algorithms | Manual analysis by users |

Instant trade execution based on an algorithm | User manually places orders |

Continuously updates strategies based on market | No learning, fixed user-based strategies |

Tailors advice to individual user profiles | Generic advice or none |

Real-time, 24/7 monitoring of market fluctuations | Limited to the user’s active hours |

Automated risk controls and alerts | User manually monitors risk |

Interactive with intelligent notifications | Basic alerts only |

Automates tasks to reduce delays | Manual processes slow execution |

How Does AI Stock Trading Apps Work – The Blueprint

We at Deliverables Agency build AI stock trading solutions that follow a structured workflow, ensuring smarter insights, cleaner operations, and actionable recommendations for businesses and financial institutions. Here’s how our process works:

User Registration & Profile Setup

We start by creating accounts and collecting business-specific preferences, investment goals, and risk parameters. This information allows our AI to generate tailored insights that align with institutional strategies and objectives.

Market Data Integration

We connect the platform to live feeds from news channels, exchanges, and financial reports. Combining these sources provides a unified data stream, ensuring accurate and timely market signals for corporate trading decisions.

Data Preprocessing & Feature Extraction

Raw market data often contains noise. Our system cleans and filters it, highlighting relevant trends, volume changes, and sentiment markers. These extracted features form the foundation of predictive models.

AI Model Selection & Training

We develop personalized AI models for different trading strategies. Some analyze patterns, others respond to sequences or market shifts. Models are trained to reflect the institution’s goals, producing actionable, strategy-aligned recommendations.

Strategy Development & Backtesting

Before implementation, strategies are tested against historical data. This ensures recommendations are validated, reliable, and aligned with the organization’s trading approach and risk tolerance.

Real-Time Market Analysis

Our platform continuously monitors price movements, trading volumes, and sentiment shifts. Real-time insights enable firms to act quickly, reducing delays and capitalizing on short-term market opportunities.

Trade Execution

Trades are executed securely through integrated broker platforms. Automation eliminates delays and emotional bias, enabling clean, precise, and timely transaction execution.

Risk Management

We actively monitor portfolio exposure and market volatility. Alerts and automated checks help businesses mitigate risk, protect assets, and respond effectively to sudden market changes.

Portfolio Optimization

Holdings are continuously adjusted as markets evolve. Detailed performance reports help organizations track returns, evaluate strategies, and refine future trading decisions.

Continuous Learning & Improvement

Our AI models adapt to evolving market patterns, improving accuracy over time. Institutions receive insights that remain up-to-date with emerging trends and market cycles, ensuring long-term relevance and efficiency.

What Are the Types of AI Stock Trading Apps?

Not all trading businesses follow the same approach, and different app types serve unique institutional or corporate needs. At Deliverables Agency, we design AI trading solutions aligned with the target market, user expertise, and business objectives. Here’s an overview of the types we specialize in:

Basic Trading Apps

We develop streamlined apps that offer simple access to charts, watchlists, alerts, and direct order placement. Ideal for corporate clients providing foundational trading tools, these apps ensure a clean, efficient experience, especially for teams or clients starting with digital trading solutions.

Copy or Social Trading Apps

Our copy trading platforms allow users to monitor professional portfolios and replicate strategies in real time. Activity feeds, shared strategies, and collaborative tools build trust, enabling institutions to offer clients a guided, example-based trading experience.

Robo Advisory or Hybrid Apps

We design hybrid solutions combining automated portfolio guidance with manual controls. Users receive AI-driven recommendations while retaining the ability to adjust strategies, providing structured yet flexible trading options for professional clients or business users.

Brokerage Integrated Full-Service Apps

Our premium platforms integrate charts, insights, order execution, taxation tools, reports, research, and guided strategies. These apps cater to active traders and institutional clients seeking an all-in-one, fully managed trading experience.

Simulated/Paper Trading Apps

We build training-focused environments powered by real market data, allowing users to practice strategies without risking funds. These apps help institutions train employees or clients, test new approaches, and prepare for live trading with confidence.

Must-Have Features in an AI Stock Trading Development App

Building an AI stock trading app is not an overnight process. You need to identify the right features. The success of the platform depends on how well it supports decision-making, manages risk, and delivers reliable performance. Here are the features that ensure the app meets user expectations while handling market complexity.

AI Stock Trading Development App Features for Trader / Investor

We build AI stock trading apps depending on the everyday needs of traders and investors. Users want simple tools that help them understand the market, act quickly, and stay in control of their money. These features combine real-time data with AI insights and automation, making trading easier, more practical, and more manageable for both new and experienced market participants.

These are the main features regular users interact with.

Real-time stock prices – Live market data with charts

AI trading signals – Buy, sell, or hold suggestions

Pattern recognition – AI spots trends and breakout signals

Portfolio tracking – View profits, losses, and asset mix

Automated trading – Place trades automatically based on rules

Risk alerts – Warnings for high volatility or sudden drops

Strategy customization – Choose aggressive, balanced, or safe styles

Performance reports – Daily, weekly, and monthly summaries

Top Features an AI Stock Trading Development App Should Have for Admins

Running an AI stock trading app requires strong admin-level control to ensure accuracy, safety, and smooth performance. A well-designed admin panel keeps operations transparent with these features-

These features help the company run, monitor, and control the platform.

User management – View, approve, suspend, or verify users and brokers

Role control – Assign permissions for traders, analysts, or support teams

AI model control – Update, train, or pause AI trading models

Market data control – Manage data feeds, exchanges, and price sources

Transaction monitoring – Track all trades for errors or unusual activity

Risk and compliance tools – Set limits to meet SEBI, SEC, or exchange rules

Reports and analytics – View platform performance, revenue, and usage

Alert management – Get notified about system failures or high-risk trades

Best Monetization Tactics that Deliverables Agency Undertakes for AI Stock Trading Apps

Deliverables Agency suggests the following monetization tips to develop a AI stock trading app securely. Our prime focus is on security, transparency, and long-term value. Our monetization strategies can generate sustainable revenue without compromising user trust, data protection, or trading integrity. This way, we ensure the app remains compliant and reliable as user demand and market grow activity. Here are a few tips from our end-

A Subscription Model – Offering monthly or yearly plans with premium features as well as exclusive insights.

Commission on Trading – Charging a commission for every trade via the app.

In-App Purchases – Offer add-ons like advanced analytics or educational content for extra fees.

Advertisements – Show targeted ads from financial service providers within that app.

Affiliate Marketing – Earn commissions by recommending financial products or brokerage services.

Freemiums Model – Offer basic features, free as well as premium trading tools for an extra fee.

Challenges in Stock Trading App Development – How to Overcome Them

Stock trading platforms experience pressure from unpredictable markets as well as strict regulations. The need has increased due to cybersecurity demands as well as user expectations for instant performance. Considering these, Deliverables Agency can help businesses move through these obstacles with the right plan alongside practical execution.

High Market Volatility

Fast market swings create pressure on data systems and execution modules. Deliverables Agency can build stable backend structures to support speedy reactions & steady performance during demanding trading periods.

Complicated Regulatory Requirements

Legal rules vary across regions and require careful planning. The team ensures full compliance through structured audits, risk checks, and aligned documentation so the platform remains safe for public use.

Security Risks with Data Protection Needs

Trading platforms attract malicious actors searching for gaps. Strong encryption, activity logs, as well as secure identity checks help users protect their accounts. Deliverables Agency strengthens all security points before launch.

Heavy Data Loads during Peak Hours

Thousands of users often interact at the same time. Deliverables Agency can optimize servers * and data pipelines to support smooth performance.

User Trust

Users select platforms that feel transparent. Clean design alongside consistent performance help Deliverables Agency create apps that can ensure lasting results.

New Innovations & Trends in AI Stock Trading Apps

AI stock trading apps are evolving rapidly, and integrating the latest innovations can give your platform a competitive edge. Adopting these trends helps you enhance user experience while improving trading accuracy. Your app can implement the following developments-

Using Explainable AI – Explainable AI lets you understand how AI makes decisions to create user trust with regulatory compliance.

Voice Trading – It offers voice commands to ensure speedier trading approaches.

Blockchain Integration – This makes the process simplified through decentralized data management.

Analyzing the Sentiments – This implements social media with news to improve the trading predictions.

Cross Platform Trading – This supports smooth trade execution across various devices (including wearables).

Knowing from Personalized AI Coaches – This offers users AI-based coaching to improve their trading plans.

Parameters That Impact the Cost of AI Stock Trading Apps

We at Deliverables understand that the cost to develop a AI stock trading app is the prime aspect every founder or business developer relies on. Several factors affect the development cost of your trading app, some of which are-

Features to Consider

The number and complexity of features directly affect development cost. Advanced AI models, automation, analytics, and custom dashboards require more time, testing, and skilled development effort.

Data Integration Needs

Real-time market data, historical records, and third-party APIs increase costs based on licensing fees, data accuracy requirements, update frequency, and the reliability level expected from data providers.

Platform Support

Building the app for multiple platforms like iOS, Android, and web demands separate development, testing, and optimization efforts, increasing overall cost compared to a single-platform solution.

Security Requirements

AI stock trading apps require strong security measures such as encryption, authentication, fraud detection, and compliance checks, which significantly raise development, infrastructure, and quality testing expenses.

Team Expertise

Hiring experienced AI engineers, data scientists, and blockchain or fintech developers increases cost but ensures accurate models, secure systems, and a reliable trading experience for users.

Updates & Maintenance

Ongoing updates, bug fixes, security patches, and feature improvements are essential. Long-term maintenance costs should be planned to keep the app stable, relevant, and competitive over time.

AI Stock Trading App Development Cost Comparison by Country

For Asia

Country | Hourly Rate (USD) | Development Cost | AI & Data Expertise |

|---|---|---|---|

India | $20–$40 | $25,000–$60,000 | Strong AI & fintech talent |

Southeast Asia (Vietnam, Philippines) | $25–$45 | $30,000–$70,000 | Growing AI skills |

For Europe

Country | Hourly Rate (USD) | Development Cost | AI & Data Expertise |

|---|---|---|---|

Eastern Europe (Poland, Ukraine) | $35–$60 | $40,000–$90,000 | Advanced AI engineering |

Western Europe (UK, Germany) | $60–$100 | $70,000–$150,000 | Enterprise-grade AI |

For US & Canada

Country | Hourly Rate (USD) | Development Cost | AI & Data Expertise |

|---|---|---|---|

United States | $80–$150 | $100,000–$150,000 | Top-tier AI innovation |

Canada | $70–$120 | $90,000–$150,000 | Strong AI research |

For Australia

Country | Hourly Rate (USD) | Development Cost | AI & Data Expertise |

|---|---|---|---|

Australia | $70–$130 | $85,000–$150,000 | Reliable fintech talent |

Build a Stock Trading App with Us Today

Building a strong trading platform takes far more than technical work because traders rely on secure processes alongside a frictionless experience that helps them act at the right moment. Demand for AI trading agent development keeps expanding as traders move to platforms that read patterns faster than manual review.

An app with smart features real-time insights can earn attention in a crowded FinTech market. Deliverables Agency guides businesses through each stage with a clear and organized approach that matches real user expectations.

Our team focuses on speed, clarity, and long-term stability so the final outcome can grow alongside an active user base. Connect with us to share your vision and begin shaping a trading platform that feels efficient & ready for serious participation in modern markets.

Have an Idea for an App or Website?

At Deliverables, we specialize in building custom digital products that solve real-world problems. Tell us your idea, and our expert team will help you craft a plan to build your dream.

Some Topic Insights:

Do you know the price of an AI stock trading app?

The price for the AI stock trading app may vary depending on a few parameters, including the app's features, platform support, and other complexities. Basic apps start lower, & apps with advanced AI or real-time data feeds may cost more. Note that maintenance as well as compliance may increase the total amount.